In the pursuit of corporate longevity, «growth» is the objective that occupies the mind of every executive. However, growth is rarely a linear path. For leaders tasked with steering a company toward new horizons, the Ansoff Matrix serves as a vital compass. First published in the Harvard Business Review in 1957 by Igor Ansoff, this strategic planning tool remains a gold standard for mapping out a firm’s future direction.

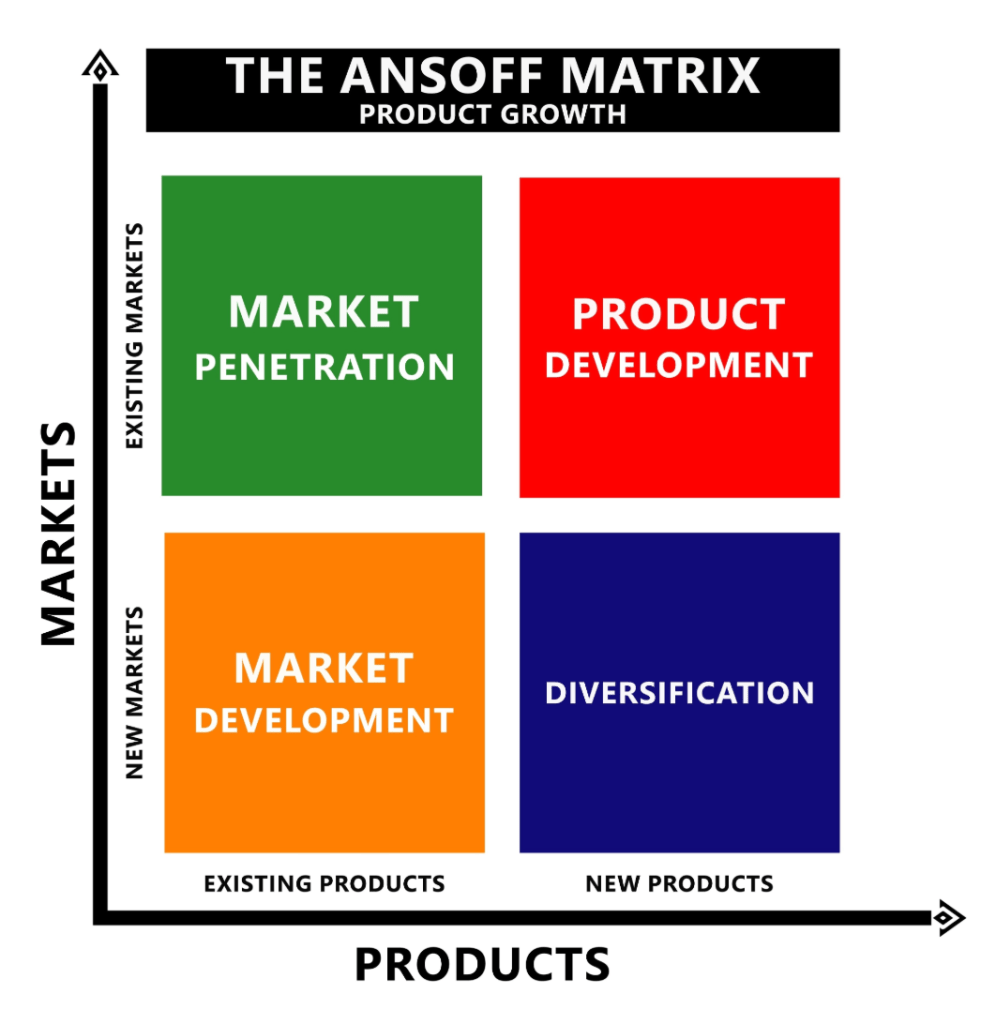

The matrix provides a structured framework that helps executives, senior managers, and marketers devise strategies for future growth by focusing on two key variables: Products (what you sell) and Markets (whom you sell to). By crossing these variables, the matrix outlines four distinct potential growth strategies, each with its own risk profile and operational requirements.

1. Market Penetration: The foundation of growth

Market Penetration is the strategy of selling more of a company’s existing products to its existing markets. It is generally considered the lowest-risk quadrant because the business is operating within a familiar environment, utilizing established distribution channels and understood customer behaviors.

- Primary Objective: To increase market share within the current segment.

- Tactics: This is often achieved through aggressive marketing, loyalty programs, volume discounts, or refining sales processes to steal share from competitors.

- Why it Matters: It allows a company to capitalize on economies of scale and deepen its brand presence without the costs associated with new product R&D or entering unknown territories.

2. Product Development: Innovating for the loyal base

When a company identifies that its current market has more needs than its current catalog can meet, it moves into Product Development. This involves offering new products to existing markets.

- Primary Objective: To capture more «wallet share» from the current customer base by solving different problems for them.

- Tactics: This requires significant investment in Research and Development (R&D) and product design. A classic example is a smartphone manufacturer releasing a tablet or smartwatch to its existing loyal users.

- Risk Profile: Medium. While you know your customer well, the risk lies in whether the new product will be technically viable or if it will be accepted by the market.

3. Market Development: Expanding the horizons

Market Development occurs when a business takes its existing products and enters new markets. This could mean expanding geographically (moving from a domestic to an international market) or targeting a new demographic segment that previously had no exposure to the product.

- Primary Objective: To find new applications or new users for a proven product.

- Tactics: This often involves market research into new regions, adjusting pricing strategies for different economic climates, or localized branding efforts.

- Risk Profile: Medium to High. While the product is a «known quantity,» the company must navigate unfamiliar regulatory environments, cultural nuances, and different competitive landscapes.

4. Diversification: The high-stakes frontier

The final quadrant, Diversification, involves launching new products into new markets. Because the company is simultaneously introducing an unproven product and entering an unfamiliar market, this is the highest-risk strategy in the Ansoff Matrix.

- Primary Objective: To move away from a maturing or declining industry and find entirely new revenue streams.

- Tactics: Often achieved through acquisitions or the creation of entirely new business units.

- Risk Profile: High. This requires a significant departure from the company’s core competencies. However, if successful, it provides the greatest rewards and protects the company from industry-specific downturns.

Choosing the right path: A strategic synthesis

The Ansoff Matrix is not merely a classification tool; it is a risk management framework. As a leader moves from the top-left (Market Penetration) to the bottom-right (Diversification), the degree of uncertainty and the requirement for new capabilities increase exponentially.

| Strategy | Risk Level | Focus |

| Market Penetration | Low | Market Share & Efficiency |

| Product Development | Moderate | Innovation & R&D |

| Market Development | Moderate | Geography & Demographics |

| Diversification | High | New Business Ventures |

Eksporter til Regneark

Integrating the Ansoff Matrix with other models

To master strategy, the Ansoff Matrix should not be used in isolation. Insights from other models in your toolkit can sharpen its application:

- P.E.S.T. Analysis: Use this to determine if the macro-environment (Political, Economic, Social, Technological) supports a Market Development or Diversification move.

- Porter’s Five Forces: Before a Market Penetration push, analyze the «Competitive Rivalry» to see if a price war is sustainable.

- Growth-Share (BCG) Matrix: Identify which of your «Stars» or «Question Marks» are the best candidates for Product Development.

Conclusion

The Ansoff Matrix remains an essential tool because it forces clarity. It prevents «strategic drift»—the dangerous tendency for companies to try to do everything at once without a clear understanding of the risks involved. By deciding whether to focus on newness in products, markets, or both, a CEO can align their team’s energy and capital toward the most viable path for growth.

Legg igjen en kommentar